- Nvidia’s stock experienced a significant 17% decline due to competition from DeepSeek, a Chinese AI company offering similar performance at a lower cost.

- Investor confidence is shaken, delaying typical dip-buying behavior; recovery only began after a 21% drop from Nvidia’s peak.

- Despite market instability, Amazon and Microsoft show strong commitment to technology, pledging a combined $300 billion in capital expenditures.

- Nvidia’s upcoming earnings report on February 26 is critical, with expectations set lower compared to last year’s explosive growth.

- Nvidia faces a crossroads in its growth narrative, with potential seen in the anticipated Blackwell chips and lower stock valuations.

- The future will determine if Nvidia can reclaim its industry dominance or remain vulnerable in an evolving market landscape.

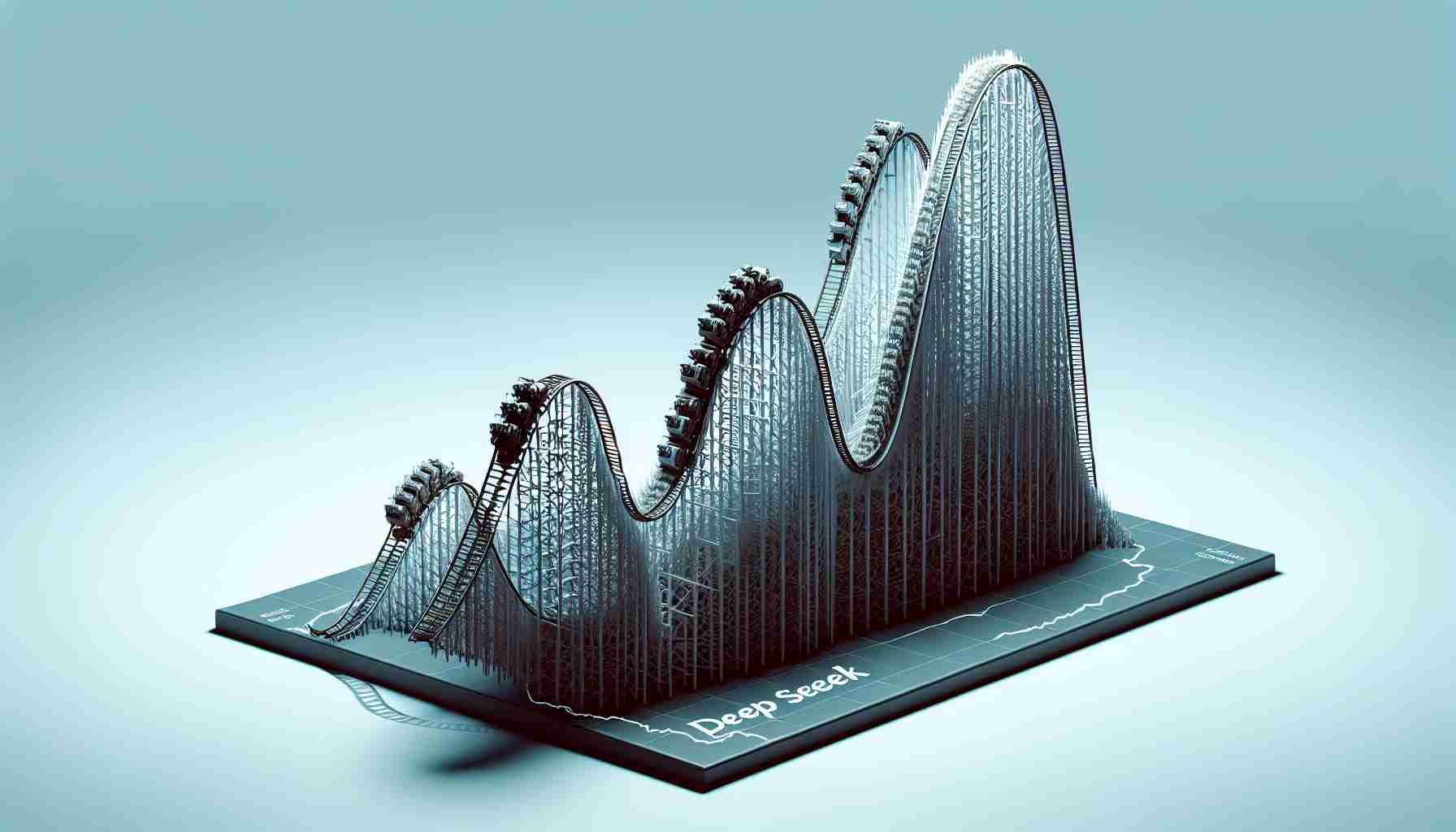

The world’s eyes are on Nvidia as it teeters on the precipice of uncertainty, its stock recently rocked by an unexpected competitor. Nvidia’s shares plunged 17% in one tumultuous day, spurred by DeepSeek—a Chinese AI upstart—boasting similar performance at a fraction of the cost. Although some ground has been regained, the shadow of that seismic shift looms large.

This dramatic downturn signals a palpable unease among investors. Historically quick to swoop in during dips, they’re now hesitating, wary of potential slowdowns in AI investment. Astonishingly, it took a staggering 21% dip from Nvidia’s peak before these bargain hunters ventured back, a rarity that hints at deeper trepidation.

Amidst this turmoil, heavyweights like Amazon and Microsoft have pledged a combined $300 billion in capital expenditures, bolstering the tech landscape. Yet, Nvidia stands at a crossroads—a Goliath suddenly seen as vulnerable, its once-commanding story marred by doubt.

The upcoming earnings report on February 26 serves as a crucial juncture. Nvidia, a titan with a history of double-digit revenue growth, now faces tempered expectations. As analysts and investors scrutinize each line of the balance sheet, Nvidia must navigate past last year’s explosive 265% growth, with current estimates tempered to a mere 73%.

Yet, a silver lining glows amidst the storm clouds. Some see the recent selloff as an attractive buying opportunity, with Nvidia’s valuation dropping to more appealing levels. How the company capitalizes on future AI shifts, spurred by its much-anticipated Blackwell chips, could determine if Nvidia reclaims its throne or remains adrift in these volatile waters. The outcome promises to be nothing short of riveting.

Nvidia’s Rollercoaster: Can They Rebound Amid New Challenges?

**Deepening the Nvidia Drama: What the Source Article Didn’t Say**

Nvidia’s recent stock plunge highlights a pivotal moment for the company, caught in an evolving landscape where competitors are rapidly advancing. While the source article provides a thrilling account of Nvidia’s current situation, several additional factors continue to shape this narrative:

1. **DeepSeek’s Innovations:**

– DeepSeek, the new competitor mentioned, has been gaining significant attention in both domestic and international markets. Known for its innovative use of AI in semiconductor technology, DeepSeek is not only providing cost-effective solutions but also driving technological advancement by integrating cutting-edge machine learning techniques into its chips.

2. **Market Influence Beyond DeepSeek:**

– Nvidia’s challenges don’t solely stem from DeepSeek. The expanding competition from other tech giants, such as AMD and Intel, is also contributing to the disrupted market. Each of these companies is investing heavily in AI and GPU technologies, which directly impacts Nvidia’s market share and investor confidence.

3. **Economic Factors:**

– The global chip shortage continues to exert pressure on the semiconductor industry. Despite Nvidia’s strong position, supply chain challenges could further impact production costs and timelines, potentially hindering growth.

4. **Strategic Partnerships:**

– Beyond Microsoft and Amazon, Nvidia seeks new partnerships to expand its market reach and technological capabilities. Collaborations with cloud service providers and AI research institutions are part of its strategy to enhance its portfolio and services.

5. **Regulatory Landscape:**

– Increasing regulatory scrutiny in major global markets could affect how Nvidia operates. Antitrust investigations and new digital regulations may pose additional hurdles for expansion and mergers.

**Key Questions and Answers**

– **What is the potential impact of Nvidia’s new Blackwell chips?**

– The Blackwell chips are expected to be Nvidia’s response to the competitive pressures. If successful, they could set new performance benchmarks in AI and machine learning, potentially recapturing market confidence and boosting Nvidia’s stock.

– **Why are investors hesitant despite the recent selloff opportunity?**

– Investor hesitation stems from broader economic uncertainties and the unpredictable pace of AI investment growth. Additionally, the potential for ongoing market competition and regulation adds layers of risk.

– **Could Nvidia’s earnings report change the current dynamics?**

– Yes, a positive earnings report exceeding market expectations could reassure investors and signal stability, potentially boosting the stock price and restoring confidence.

– **How significant is the combined investment by Amazon and Microsoft in the tech landscape?**

– The combined $300 billion investment underscores the robust demand for technology innovation, reinforcing the critical role Nvidia and other tech companies play in the broader digital economy.

**Related Resources**

– Explore more on Nvidia’s challenges and strategies on the [Nvidia website](https://www.nvidia.com).

– Stay informed on tech investments with insights from [Amazon](https://www.amazon.com) and [Microsoft](https://www.microsoft.com).

As Nvidia navigates these tumultuous waters, the outcome of its strategic decisions and technological innovations will have a profound impact on its future and the broader tech industry. The journey promises to be as riveting as it is uncertain.